Meridian Launches U.S. Accounts in the Philippines: The Lowest-Cost Way to Receive Dollars

60,000+ accounts opened in one month. Instant settlement. Just 1% total cost.

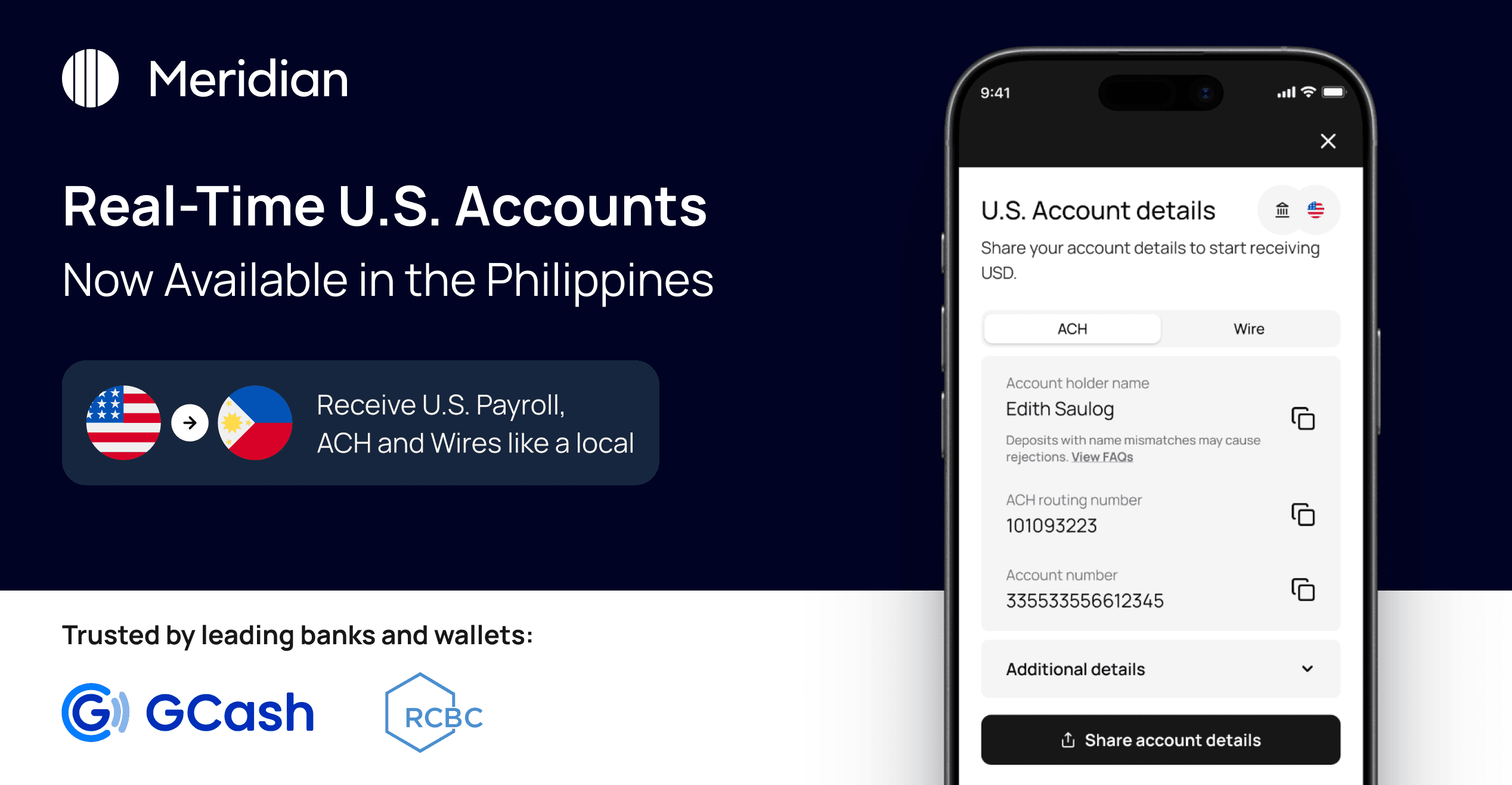

Today, we're announcing the launch of U.S. accounts in the Philippines, powered by the Meridian Real-Time Deposits (RTD) network. In partnership with GCash and RCBC and with support from DICT, we've put a U.S. virtual bank account in the hands of over 60,000 Filipinos in the first 30 days, no U.S. address, Social Security number, or residency required.

Get Paid From the U.S. Like a Local

For the first time, Filipinos can receive payments directly from U.S. payroll systems, local ACH transfers, wire transfers, and any domestic U.S. payment method directly into their Philippine bank accounts, instantly.

No more waiting days for SWIFT wires, PayPal transfers, or Western Union remittances.

No more losing money to hidden fees and unfavorable exchange rates.

With Meridian-powered U.S. accounts embedded inside top Filipino wallets and financial institutions, funds transfer in real-time, and recipients can hold their dollars or convert to pesos whenever they choose.

Seamlessly Receive Dollars in the Philippines

Traditional remittance services charge 3–8% per transaction. Wise charges around 1.8%. The Meridian RTD network delivers funds at just 1% total cost, making it the most affordable way to send money from the United States to the Philippines.

In 2024, the Philippines received $38.34 billion in remittances, with roughly 40% coming from the United States. For millions of Filipino freelancers, remote workers, and families with loved ones abroad, every percentage point matters.

Until now, receiving a U.S. payment meant:

- Waiting days for funds to arrive

- Paying steep platform and FX fees

- Having no visibility into where your money is during transit

- Earning in dollars without the ability to save in dollars

With their U.S. account, recipients get their own U.S. account number and routing number. USD payments from U.S. employers, clients, and family members arrive the same way they would for someone living in the United States, because, as far as the U.S. payment system is concerned, it's a domestic transfer. Moments after being received, the USD can be converted to Pesos at a cost of just 1%, making it the most seamless way to receive USD in the Philippines.

91 Million Filipinos Now Have Access

Through our partnership with GCash, the leading finance super app in the Philippines with 91 million users, we've made U.S. accounts available already in the pocket of every Filipino. RCBC, one of the Philippines' most digitally advanced banks, is offering this capability to their 16 million customers through the RCBC Pulz app.

The response has been immediate. In the first 30 days:

- 60,000+ USD accounts opened organically

- 40% conversion rate from applications to issued accounts

- Users are already connecting their new accounts to U.S. payroll processors, bill pay systems, PayPal, Wise, and brokerage accounts

The demand for better access to dollars in the Philippines is real, and it's growing fast.

How it Works

Opening a U.S. account takes less than two minutes, directly within the GCash or RCBC Pulz app as well as other participating financial institutions. Users verify their identity using their Philippine ID—no U.S. documentation needed.

Once opened, the account works like any U.S. bank account:

- Receive ACH, wire transfers, FedNow and RTP payments from any U.S. bank

- Hold funds in USD to avoid currency fluctuations

- Convert to pesos instantly for a 1% total cost when ready

- Transfer to a linked local PHP account in real-time

The entire experience happens within the app users already trust. Users never interact with Meridian directly, we’re the infrastructure enabling trusted Filipino financial institutions to issue U.S. accounts to their retail and corporate clients at scale. Meridian operates as a fully regulated payments network in the United States and the Philippines, enabling compliant, non-resident issuance of U.S. accounts through licensed local financial institutions.

Powering a Faster Future For Global Payments

We started Meridian with a simple thesis: the dollar is already global, but access to the systems that hold and move it is not. Cross-border payments infrastructure has been solving the wrong problem: treating every international transaction as a foreign exchange event when, in reality, many recipients would hold dollars if they could.

The RTD network changes that. By enabling overseas banks and wallets to issue real U.S. accounts to their customers, we're making global payments local, and dollar clearing seamless. A payment from New York to Manila becomes a domestic ACH transfer—not a $30, three-day international wire. This requires not just new technology, but a regulatory and settlement framework that traditional banks and wallets cannot build on their own.

Over sixty thousand Filipinos have already discovered a better way to receive dollars. Millions more are next.

Meridian-powered USD accounts are live today through GCash and RCBC Pulz, with additional banks and wallet partners coming online in the Philippines and around the world next. For enterprise partnerships, contact us at mnai.com.